Understanding Car Insurance Requirements in the United States

:max_bytes(150000):strip_icc()/Insuring_Your_Car_SourceFile_V2-96858e470a6a4e32a6d791108e4d5ea4.jpg)

When I first delved into the regulations surrounding car insurance in the United States, I quickly realized how complex they can be. Each state sets its own rules, making it crucial to stay informed. Some states require only liability coverage, while others mandate additional protections. Understanding these requirements not only ensures compliance but also safeguards against potential financial pitfalls in the event of an accident. Given the diversity in state laws, it’s essential to review and comprehend the specifics for where you reside or plan to drive.

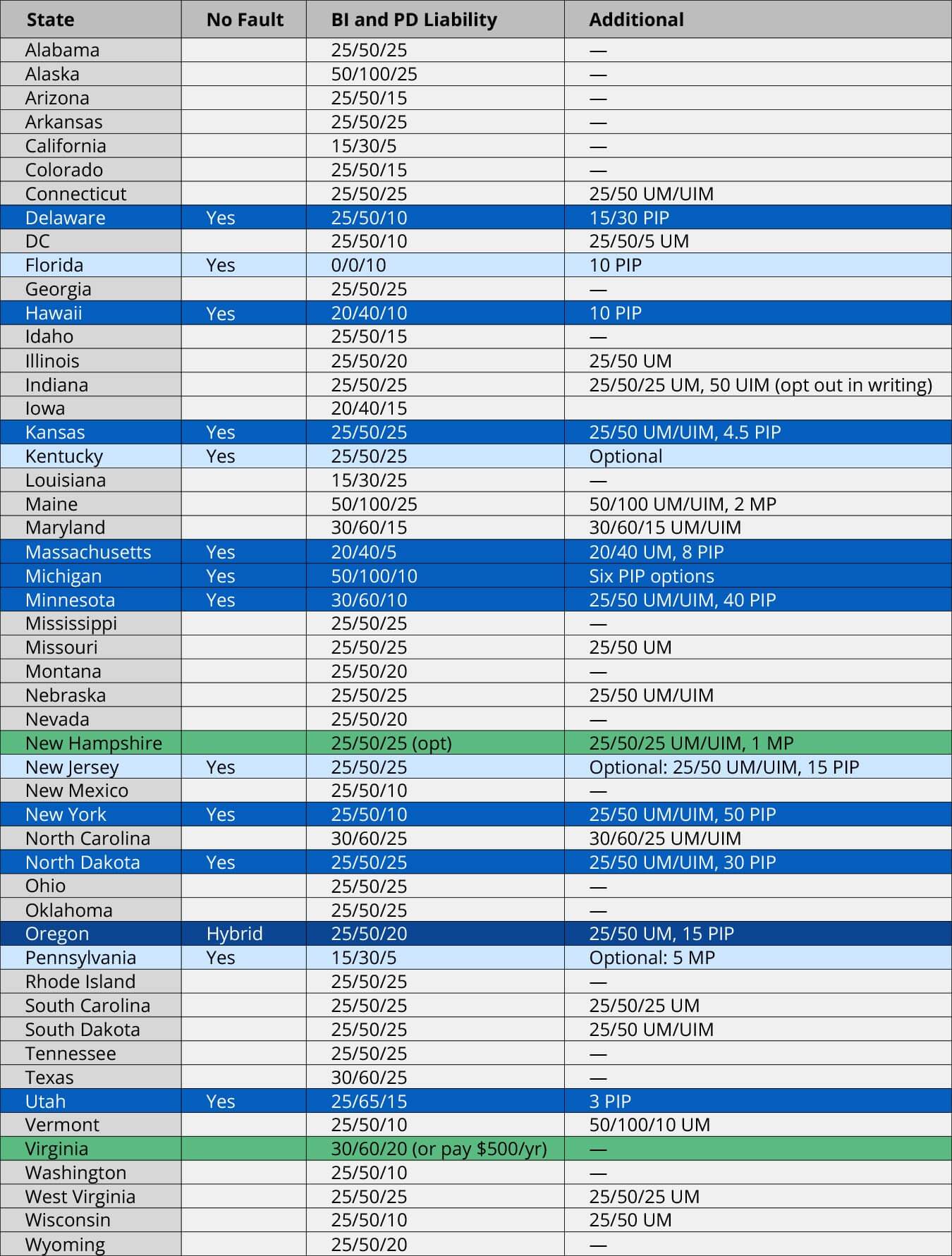

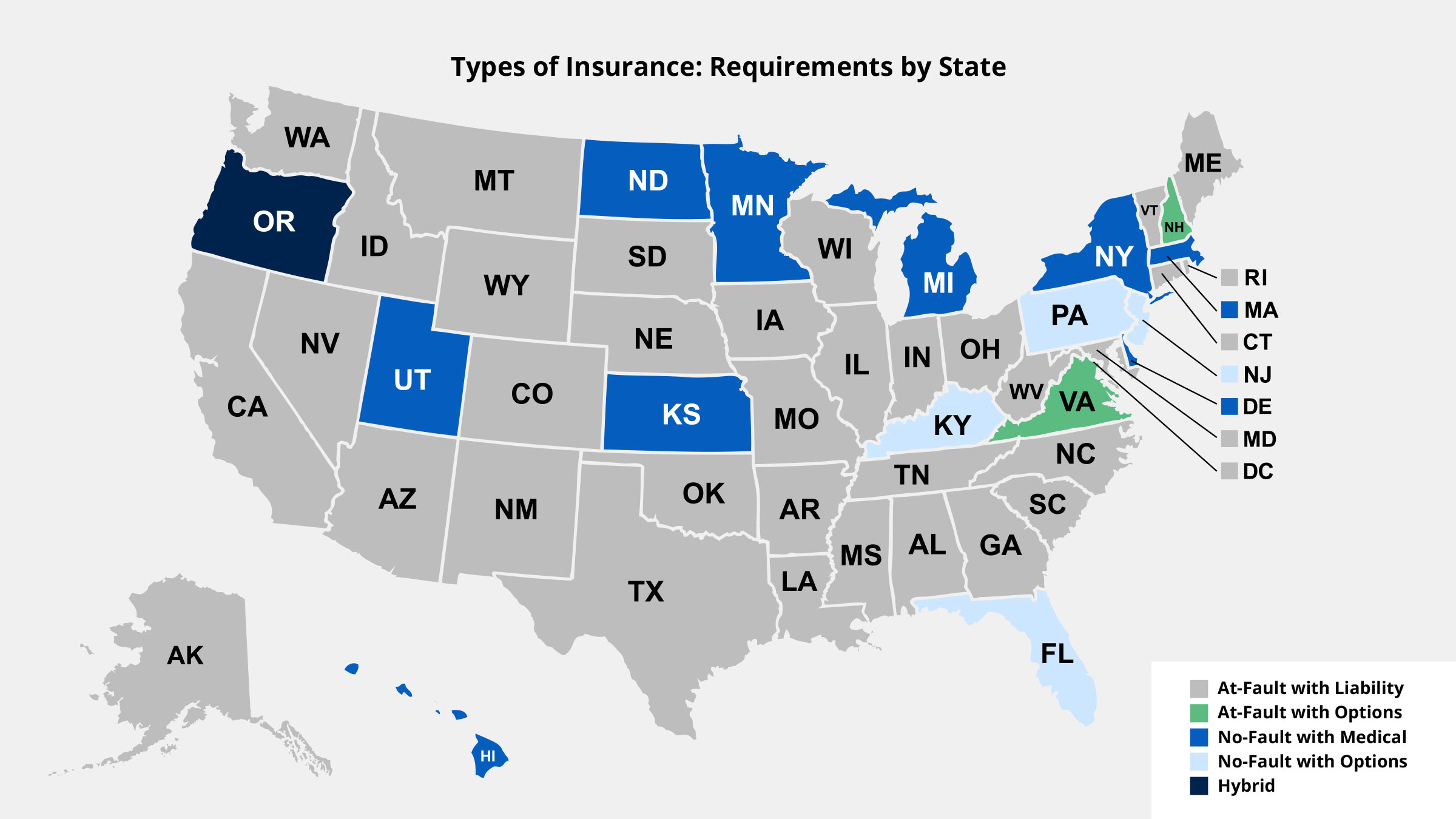

Minimum Car Insurance Requirements by State

Minimum Car Insurance Requirements by State

Navigating car insurance regulations can be daunting. Each state has unique requirements, which significantly impact policy specifics. For instance, while some states only require liability coverage, others mandate additional protections like uninsured motorist coverage. It is crucial to know your state’s minimum requirements to avoid legal issues and financial risks. Staying updated on these mandates ensures that your coverage is both compliant and adequate. Therefore, regularly reviewing your state’s guidelines helps in maintaining the right protection for your vehicle and peace of mind.

Minimum Car Insurance Requirements in California

Living in California, I need to ensure my car insurance meets state requirements. California mandates that I carry liability coverage. Specifically, I need at least $15,000 for injury or death of one person, $30,000 for injury or death of more than one person, and $5,000 for property damage. This coverage protects me financially if I am at fault in an accident. Additionally, California offers optional coverages such as uninsured motorist and medical payments, which can provide further security. Ensuring my policy meets these minimums helps me stay compliant with state laws.

Minimum Car Insurance Requirements in Texas

In Texas, I must obtain liability insurance to meet state requirements. The mandatory minimum includes $30,000 for bodily injury per person and $60,000 per accident. Property damage coverage is set at $25,000. This ensures I can cover costs if I’m responsible for an accident. Additionally, Texas promotes personal injury protection (PIP) and uninsured motorist coverage as optional extras. These can offer me broader financial protection. Staying informed about these requirements helps me remain compliant with state laws and protect my financial well-being.

Factors Affecting Car Insurance Rates

Factors Affecting Car Insurance Rates

Car insurance rates vary based on several factors. My age and driving experience significantly influence the premium I pay. Younger drivers often face higher rates. The type of vehicle I drive also matters. Luxury or high-performance cars usually increase costs. My driving record is another critical factor. A clean record can lower my insurance costs, while accidents or violations can raise them. Finally, how I use my vehicle is considered. Regular commuting versus occasional driving impacts my premium. Understanding these factors helps me better manage my car insurance expenses.

Age and Driving Experience

Being a younger driver, I notice that my car insurance rates tend to be higher. This is because insurance companies view younger, less experienced drivers as riskier. As I gain more driving experience and maintain a clean driving record, my rates gradually decrease. Age plays a substantial role; older, more experienced drivers generally pay lower premiums. Insurers often reward those who have proven their ability to drive safely over time. Understanding this dynamic allows me to anticipate changes in my insurance costs as I age and gain more driving experience.

Vehicle Type and Usage

As a car owner, I realize that the type of vehicle I drive significantly impacts my insurance rates. Sports cars generally cost more to insure compared to sedans because they are often associated with higher speeds and riskier driving behaviors. Additionally, how I use my vehicle is crucial. Frequent long commutes or using the car for business purposes can increase premiums due to greater exposure to potential accidents. To optimize my insurance costs, it’s essential to choose a vehicle that aligns with my usage patterns and to provide accurate information to my insurer.

Optional Car Insurance Coverages to Consider

When choosing car insurance, I find that opting for additional coverages can be beneficial. Comprehensive coverage protects my vehicle against theft, vandalism, and natural disasters. Collision coverage ensures that repairs to my car are covered after an accident, regardless of fault. These optional coverages give me peace of mind, knowing that unexpected events won’t result in significant out-of-pocket expenses. Consequently, while they may increase my premium, the added protection they provide makes them worth considering. An informed decision can help me achieve optimal coverage tailored to my needs.

Comprehensive Coverage

When I think about protecting my vehicle, comprehensive coverage comes to mind. This type of car insurance safeguards me against non-collision-related incidents. It covers theft, vandalism, and natural disasters. If a tree falls on my car or it’s stolen, this coverage takes care of the damages. Additionally, it helps with expenses from fire and floods. I find it incredibly reassuring to know that unexpected events won’t result in substantial financial burdens. While it does increase my premium, the extensive protection provided is invaluable for my peace of mind.

Collision Coverage

Collision coverage is essential for repairing my car after an accident. This insurance covers damages from collisions with other vehicles or objects. If I accidentally hit a tree or another car, collision coverage steps in. It pays for repair or replacement costs, regardless of fault. This provision allows me to mitigate high repair costs and keep my vehicle in good shape. Though it increases my premium, the security it provides is worth it. It’s a crucial part of my comprehensive car insurance strategy, offering peace of mind on the road.

Tips for Finding Affordable Car Insurance

When seeking affordable car insurance, I prioritize comparison shopping. I use online tools and consult multiple providers to find competitive rates. Additionally, I take advantage of discounts. Many insurers offer reductions for bundling policies, maintaining a clean driving record, or installing safety features in my vehicle. Evaluating my coverage needs also helps me avoid unnecessary expenses. By regularly reviewing and adjusting my policy, I ensure I’m not overpaying. Moreover, I inquire about low-mileage discounts and pay attention to customer reviews, ensuring my choice balances cost and quality.

Comparison Shopping

When looking for car insurance, I always start with comparison shopping. It helps me identify the most competitive rates. I use online tools and resources to compare policies from different providers. By doing this, I can see a range of options and what each offers. I make sure to read reviews and check the company’s reputation before making a decision. Additionally, I look for any extra benefits or discounts that might be available. This way, I ensure I’m getting the best deal without compromising on coverage quality.

Taking advantage of discounts

I meticulously search for available discounts to reduce my car insurance costs. Many companies offer reduced rates for safe driving records, multi-car policies, or bundling home and auto insurance. I also like to review professional affiliations and memberships, as they can sometimes provide exclusive discounts. Periodically, I reassess my policy to ensure I’m benefiting from all applicable savings. As a responsible policyholder, I make it a habit to ask my insurer about any new discounts or loyalty rewards. These steps help me maintain affordable car insurance without sacrificing quality coverage.

Conclusion

Understanding car insurance requirements is essential for every driver. I make it a priority to stay informed about state-specific mandates. This not only keeps me compliant but also ensures I’m adequately protected. Reviewing different coverages helps me make educated decisions about my policy. Utilizing discounts and comparison shopping has significantly reduced my premiums. Overall, being proactive about car insurance enables me to save money while maintaining necessary coverage. Staying updated on changes in car insurance laws keeps me prepared and responsible on the road.

Importance of Understanding Car Insurance Requirements

Grasping car insurance requirements is essential for me as a driver. It ensures I am legally compliant and protected financially. Knowing the rules in my state helps me avoid fines and penalties. It also aids in selecting the right coverage for my needs. By understanding varying mandates, I can make informed decisions about additional coverages. This knowledge allows me to navigate the complexities confidently. Overall, staying updated on car insurance ensures my peace of mind on the road.

How to Stay Informed and Compliant

I make it a priority to stay updated on car insurance requirements by regularly reviewing information from my state’s Department of Motor Vehicles website. I also consult my insurance provider for the latest policy changes. Joining online forums and subscribing to industry newsletters helps me stay informed about any new regulations or updates. Attending webinars and workshops offered by insurance experts further enhances my knowledge. By keeping abreast of changes, I can ensure that my coverage remains compliant and effective, safeguarding my financial interests and legal standing.